However, its structure based on Shariah differs significantly from the conventional banking system, as it incorporates an ethical dimension. The expansion of the Islamic financial system has caught the attention of the International Monetary Fund (IMF). Nevertheless, it is unlikely that the conventional securities and banking system will be replaced by the Islamic financial model due to various regulatory, legal, and practical reasons.

The Global Growth and Concentration of Islamic Banking

Although the roots of the Islamic financial system can be traced back to the 7th century, modern Islamic banking was first introduced in 1963. However, the contemporary practice of Islamic banking was first introduced in 1975, when banks were established and required to operate in accordance with the rules and principles of Sharia. Since then, Islamic banking has rapidly become one of the fastest-growing sectors in the global banking industry. With new regions embracing Islamic banking, experts predict that the assets held by commercial banks worldwide will continue to expand. According to the General Council for Islamic Banks and Financial Institutions in 2007, there were over 300 Islamic banks and investment firms operating globally. However, as of 2022, approximately 520 banks and 1700 mutual funds worldwide adhere to Islamic principles.

According to the research department of the Union of Arab Banks, data indicates that nearly 95% of the world's Sharia-compliant assets are concentrated in just 10 countries. Iran leads the way with 29% of the global total, followed by Saudi Arabia (25%), Malaysia (11%), the United Arab Emirates (8%), Kuwait (6%), Qatar (6%), Turkey (2.6%), Bangladesh (2.1%), Indonesia (2%), and Bahrain (1.8%). In the Middle East and North Africa (MENA), which excludes Iran, there are 190 Islamic banks, with the Gulf Cooperation Council (GCC) dominating the industry with over 90% of the Sharia-compliant assets in the region.

The Asian-Pacific region presently accounts for nearly a quarter of the global Islamic finance market. Sharia-compliant institutions comprise nearly 25% of Malaysia's financial sector. Kuala Lumpur is a major contributor to the global sukuk market and has significant influence over international compliance through its participation in the Islamic Financial Services Board, which is one of the two major regulatory bodies governing Islamic finance worldwide.

Sub-Saharan Africa has a rapidly growing Muslim population and is adapting its laws and regulations to allow Islamic finance to grow, with Nigeria looking to be a hub. In Europe, London has positioned itself as the hub for sharia-compliant finance in the Western world, with the UK boasting five licensed Islamic banks and over 20 conventional banks offering Islamic financial products. Eventually, some US banks offer sharia-compliant products, and South America saw its first Islamic bank open in Suriname in December 2017.

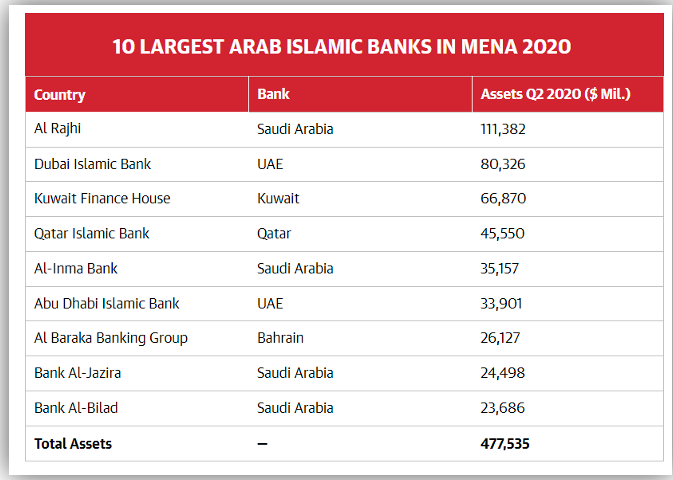

Over the past decade, Islamic finance assets have experienced significant growth, increasing from around US$200 billion in 2003 to an estimated US$1.8 trillion by the end of 2013. Despite this expansion, Islamic assets remain highly concentrated in the Gulf Cooperation Council (GCC) countries. As evidenced by the chart below, the Gulf states have the most significant number of Islamic banks, with Saudi Arabia leading in this regard.

10 largest Arab Islamic banks in Middle East and North African countries (MENA). Reference: Chloei Domat

10 largest Arab Islamic banks in Middle East and North African countries (MENA). Reference: Chloei Domat

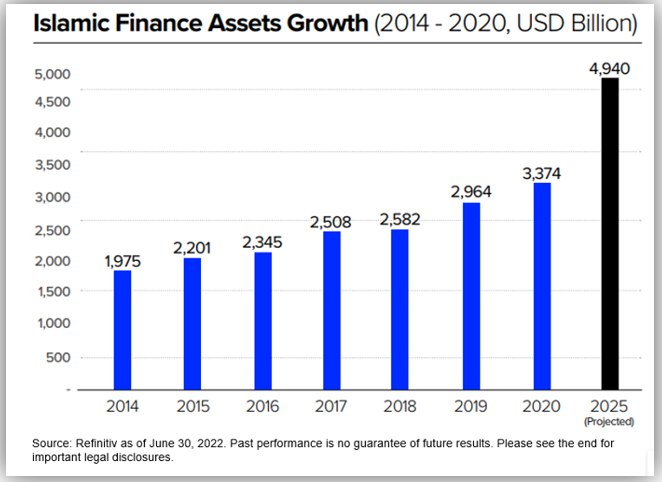

The chart presented below depicts the rate of expansion in the Islamic finance assets from 2014 onwards. It is projected that by 2025, the value of finance assets will reach almost $5000 billion USD.

Islamic Finance Assets Growth (2014-2020, USD Billion). Reference: Shaima Hasan

Exploring the Mechanics and Potential Pitfalls of Shari'ah-Compliant Banking

Islamic finance includes various financial activities such as banking, leasing, securities (Sukuk), equity markets, investment funds, insurance (Takaful), and microfinance. However, banking and Sukuk assets account for the majority of Islamic finance assets, comprising about 95% of the total. A detailed explanation of the operating mechanism of the Sukuk will be provided later.

This financial system operates in accordance with Shari'ah Islamic law, principles, and regulations. The Shari'ah prohibits the giving and receiving of interest (known as "riba"), excessive uncertainty (known as "gharar"), gambling (known as "maysir"), short sales, and any financing activities that are considered harmful to society. Instead, in Islamic finance, the parties involved must share the risks and rewards of a business transaction. Moreover, the transaction must have a genuine economic purpose without undue speculation and should not involve any exploitation of either party. The configuration of Islamic banks is designed to promote financial transactions with a primary emphasis on charitable giving and community advancement.

Islamic banking considers lending to be a partnership that creates an unjust advantage for the lender; therefore, loans must involve profit-sharing instead of interest-based transactions. Additionally, the principles of Islam restrict the range of permissible investments, either due to the characteristics of the financial instrument or the nature of the underlying company.

Shari'ah-compliant current accounts function differently from conventional accounts, as they do not pay interest. Instead, the deposit made by the account holder is considered an interest-free loan, known as a 'qard,' which allows the account holder to have ready access to their funds. For savings accounts, the bank will invest the deposited funds only in Shari'ah-compliant investments, avoiding any investments deemed harmful. The account holder will receive a portion of any profits earned, which may be referred to as a 'wakalah' (where the bank acts as an agent) or a 'murabahah' (where the bank buys and trades in commodities to earn a profit).

When it comes to purchasing a property, there are alternatives to traditional mortgages. One option involves the bank directly buying the desired property, selling it to the buyer at a profit, and allowing the buyer to pay back the amount in instalments. This type of agreement is called a ‘murabaha’ contract. Another option is to purchase the property jointly with the bank in a ‘musharakah’ (partnership) contract, gradually paying the bank for its share of the property. In either case, the bank charges the buyer additional fees to cover their costs and to reflect their partial ownership of the property.

The following benefits can be found about Islamic banking. Islamic banking is built on a foundation of justice and fairness, with a profit-sharing principle where the risk is shared between the bank and the customer. This ensures a more equitable distribution of income and wealth. The Islamic banking model is available to both Muslims and non-Muslims. Conducting business in a fair and transparent manner is a core principle of Islamic banking, with a focus on ensuring customers have a full understanding of risks and costs associated with products and services. Islamic banking also places a strong emphasis on ethical and moral dimensions of business and selecting socially desirable investments. Speculative transactions are discouraged as they are a source of instability and capital misallocation. Instead, Islamic banks focus on deploying capital to the real economy to promote socio-economic justice.

It is natural for a banking system to advocate for its operating mechanism as the most favorable. However, despite the stated benefits, not all that glitters is gold. The interpretation of Sharia regarding innovative financial products is not always universally agreed upon, particularly when it comes to Murabaha. This is because some Murabaha transactions are based on prevailing interest rates rather than economic or profit conditions. Additionally, the documentation for such transactions is often customized, leading to high issue and transaction costs. Moreover, Islamic finance institutions also face additional compliance requirements, further increasing their issue and transaction costs. Banks in this sector must engage in more extensive due diligence work than usual, as they need to be well-informed about the unique features of Islamic financial instruments. Furthermore, Islamic banks are prohibited from hedging, which makes it impossible for them to minimize their risks.

It should be noted that some Islamic financial products may not fully comply with international financial regulations. For instance, trading in Sukuk products has been limited, especially after the financial crisis. Additionally, since there is no interest involved in Islamic financial instruments, it is challenging to classify some of them as debt, which means that they do not enjoy tax benefits and can increase the Weighted Average Cost of Capital (WACC). Furthermore, it can be difficult to balance the interests of the financial institution with those of other stakeholders. This is because Islamic finance institutions must adhere to the principles of Sharia, which prioritize fairness and ethical considerations over pure financial gain. As such, navigating the complexities of Islamic finance requires a nuanced understanding of the relevant religious, legal, and economic issues.

IMF's Involvement in Islamic Finance Promotion and Advisory

Due to the significance of Islamic finance for a large number of its constituents, the International Monetary Fund (IMF) has shown continuous interest in its effects on macroeconomic and financial stability and has actively participated in setting up the Islamic Financial Services Board (IFSB). The IMF has advised its members on the impact of Islamic finance through policy guidance and skill-building efforts, particularly in the fields of regulation and supervision of Islamic banks, and the growth of domestic Sukuk markets.

The growing importance of Islamic finance has increased demand for the IMF's expertise. To better prepare itself, the IMF has created an Interdepartmental Working Group with the goals of developing an institutional perspective on the industry, building internal knowledge, and improving coordination with various stakeholders. This group has increased analytical efforts on several key areas of Islamic finance, such as regulation and supervision of Islamic banks, macro-prudential policy, safety nets, resolution, financial inclusion, consumer protection, monetary policy, Sukuk markets, public financial management, and tax policy. To further aid in identifying policy concerns and enhance collaboration with stakeholders interested in Islamic finance, the IMF has established an External Advisory Group consisting of standard setters and international experts.

Understanding the Unique Advantages and Challenges of Sukuk: A Comparison to Conventional Bonds

Islamic bonds, also known as Sukuk, bear resemblances to asset-backed securities, but there are some differences compared to conventional bonds. In contrast to conventional bonds that promise to repay a debt with a fixed interest rate, Sukuk are structured to guarantee the presence of an underlying asset, and the principal amount is not assured. Additionally, the return to investors is associated with the performance of the underlying assets.

Sukuk can take on a variety of structures. They can be issued as asset-backed, where investors have a claim on the underlying asset, or asset-based, where the claim is on the originator and not the underlying assets. As Sukuk issuance has accelerated, different structures have emerged, including partial ownership in receivables, lease-based, profit and loss-sharing partnerships, and convertible and exchangeable trusts. In addition to that Sukuk are a potential option for financing infrastructure, but their use raises concerns regarding financial stability and consumer protection. They are similar to Public-Private Partnership financing in that investors fund assets and eventually transfer ownership to the government upon maturity, resulting in genuine securitization. It is important to address the specific issues related to consumer protection in this type of financing.

Sukuk are becoming an increasingly popular form of financing, but they come with their own unique set of advantages and challenges. The issues of consumer protection and financial stability have already been raised, but in addition, there are many other factors worth considering.

Sukuk have a key advantage over traditional bonds in that their worth is tied to the value of the assets supporting the sukuk certificate. When the asset value goes up, the value of the ownership of that asset, backed by the sukuk, increases as well. In contrast, bonds lack this feature as it is not possible to increase the primary debt in a bond, and any rise in revenue from a bond is solely due to the fixed interest rather than any tangible boost in value or productivity. Furthermore, sukuk are designed to adhere to Sharia principles while enhancing the quality of life in Islamic communities and fostering economic development in these societies.

Nevertheless, there are certain obstacles associated with sukuk. Accessing the sukuk market can be difficult for corporates or sovereigns with a low credit rating because the obligor's credit rating is a crucial element in attracting investors. If an ijara-based sukuk is utilized, the obligor must have suitable halal income-producing assets to serve as the underlying funding arrangement, and the substitution of assets may not be possible without the right documentation. This may limit the obligor's ability to sell or deal with the asset during the transaction's lifespan.

In contrast to the conventional bond market, the standardization of sukuk issuance documents has been slow to develop, resulting in cost implications. If the sukuk structure differs significantly from typical structures, sharia scholars may be required, which adds additional costs and unpredictability to the transaction structuring process. Since sharia scholars have varying views on the compliance of the structures, there is no unified and established body of opinion on these issues. Furthermore, the tax treatment of sukuk may differ from conventional bonds in certain jurisdictions.

Last but not least, bonds and sukuk share some similarities, such as the ability to be converted into cash by selling them on the secondary market and the possibility of being ranked by rating agencies based on their level of support. However, they also differ in terms of their underlying principles and structures. Nonetheless, both bond and sukuk markets offer diverse designs and issuers, enabling investors to choose from a range of options when considering these financial instruments.

Sustainable banking approach in the Islamic banking

Islamic banking shares similarities with conventional banking as it was mentioned before in enabling individuals to save money and obtain loans for significant purchases, such as homes or vehicles. Nevertheless, there are operational differences between the two banking systems. Islamic banking is frequently described as "ethical" or "people-friendly" due to its unique features. In addition to ethical considerations, Islamic banking is environmentally conscious, as it encourages small loans instead of large ones, thus reducing waste and promoting sustainability. Microfinance programs aid in creating a degree of social equity by providing support to individuals from low-income backgrounds. Therefore, many experts in the field believe that Islamic banks are more likely to achieve long-term sustainability than their conventional counterparts.

Despite the negative features of Islamic finance presented earlier, it has the potential to play a significant role in supporting the implementation of the Sustainable Development Goals (SDGs). As the financing needs for the SDGs are substantial, Islamic finance can serve as a substantial and alternative source of financing. Innovative Islamic financial instruments, such as green sukuk, are instrumental in supporting the SDGs and promoting environmentally friendly investments. Furthermore, leveraging Islamic endowment funds, Islamic Financial Technology (FinTech), and output sharing sukuk can provide alternative financing for micro, small, and medium-sized enterprises. Malaysia has been a leader in establishing an enabling environment for Islamic socially responsible investing (SRI) and green finance, introducing several initiatives over the years.

However, for Islamic finance to fulfill its potential and provide effective support to the SDGs, there is a need to establish a regulatory and supervisory framework, strengthen legal underpinnings of Islamic financing instruments, and develop instruments for liquidity management at the country level. At the global level, standardization of contracts and Shariah rulings is critical, along with the adoption of international standards issued by organizations like the Islamic Financial Services Board (IFSB) and the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI).

Particular attention deserves to be given to the green and sustainable edition of the sukuk previously introduced. The adoption of this type of sukuk has made significant progress and has gained popularity in numerous markets in Southeast Asia, the GCC, and Africa. Prior to the onset of the COVID-19 pandemic, the green and sustainability sukuk had already experienced substantial expansion, with their issuance more than doubling in 2019. Despite the pandemic's impact, these types of sukuk maintained their growth momentum, setting new records in 2020 and 2021. According to the London Stock Exchange Group (LSEG) data, 42% of investors reported that the primary reason for investing in green and sustainable sukuk was to fulfill their ESG (Environment, social, governance) investment mandate. Furthermore, 38% of the investors chose to invest due to the alignment of these green and sustainable sukuk with Shariah principles.

The High-level Working Group on Green and Sustainable Sukuk (HLWG) plays a crucial role in supporting and facilitating the development of the ESG sukuk ecosystem. The primary objective of the HLWG is to coordinate international efforts to establish and promote green and sustainable sukuk as a feasible financial instrument. Additionally, the HLWG is focused on directing investments towards green and sustainable projects, which will help unlock the potential of Islamic investments and facilitate the attainment of the Sustainable Development Goals (SDGs).

Islamic Finance: A Growing Alternative to Conventional Securities?

It is not an easy task to give an accurate response to the inquiry at hand. The question at hand is intricate and has many facets to consider, which has resulted in extensive deliberation and discourse among professionals in the industry. Presently, there are dedicated degree programs available that specialize in the field of economics within Islamic finance as well. These examples serve as a testament to the significant growth and progress that the study field has experienced in recent times.

On the one hand, many papers argue that the principles and practices of Islamic Finance offer a more ethical and sustainable alternative to conventional finance. According to that perspective, Islamic Finance is grounded in the principles of fairness, transparency, and social responsibility and is designed to promote equitable distribution of wealth and resources. Furthermore, since Islamic Finance prohibits interest-based transactions, it is believed to reduce the risk of financial crises and promote stability in the financial system.

On the other hand, Islamic Finance is not easily scalable or adaptable enough to replace conventional securities on a large scale. Islamic Finance has experienced rapid growth in recent years, it remains a relatively niche sector of the global financial system and may not have the same degree of market depth or liquidity as conventional finance. Additionally, some experts have raised concerns about the potential for regulatory and legal challenges, particularly as Islamic Finance products and practices are not yet standardized across different jurisdictions. According to Abayomi Alawode, who is an Islamic finance expert, in addition to achieving balanced growth in the practice of Islamic finance, insolvency frameworks, and risk-management practices and the level of awareness should also be improved.

Despite these challenges, however, there is growing interest in Islamic Finance as an alternative to conventional securities, particularly in regions such as the Middle East, Southeast Asia, and North Africa, where Islamic Finance has traditionally been more prevalent. After the COVID-19, there has been a growing interest in Islamic finance assets as more investors seek out alternative forms of finance that are considered more resilient and sustainable in the face of economic uncertainty.

In the end, the question of whether Islamic Finance can replace conventional securities is likely to remain an open and ongoing one, as the global financial system continues to evolve and adapt to new challenges and opportunities. However, it is clear that Islamic Finance has an important role to play in the broader landscape of global finance and may continue to grow in influence and importance in the years to come.